Marilyn – to whom I am forever indebted for having introduced me to my beloved French bulldog Monroe (yes, I know, you catch the eponymous connection) – has distinguished herself as a exponent of animal rights. Of lesser but nonetheless material import, she is a source of pearls of wisdom. Today she sent me “Three simple rules in life” (noted below).

But before engaging in that particular context, allow me to divert the focus briefly. As no doubt you are aware, dear Reader, Artificial Intelligence (AI) is hot on the list of popular topics. Only moments ago, while listening to the latest international news, there were headline reports.

BBC October 29, 2025

Danielle Kaye

Business reporter

Nvidia has hit a new milestone, becoming the first company in the world to reach a market value of $5tn (£3.8tn).

The US chip-maker has rapidly climbed from a niche graphics-chip manufacturer to an AI titan, as euphoria about the potential of artificial intelligence keeps driving demand for its chips and propelling its stock to record highs.

The company reached a market value of $1tn for the first time in June 2023 and hit the $4tn valuation mark just three months ago.

Shares in the chip-maker rose as much as 5.6% to more than $212 on Wednesday morning, boosted by investor optimism about Nvidia’s sales in China, which has been a geopolitical flashpoint.

The world’s most valuable company – the biggest winner in the AI spending spree – has soared past its rivals in the technology sector.

It has struck deals with leading AI companies including OpenAI and Oracle as its chips continue to power the AI boom.

Nvidia’s value now exceeds the GDP of every country except the US and China, according to data from the World Bank, and is higher than entire sectors of the S&P 500.

Microsoft and Apple have also recently crossed the $4tn valuation mark, reinforcing a broader tech rally fuelled by optimism on Wall Street about AI spending.

AI-related enterprises have accounted for 80% of the stunning gains in the American stock market this year.

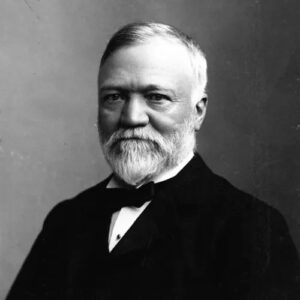

Certainly there are dampers upon the AI stock optimism. My personal credibility as a financial advisor left off with Andrew Carnegie’s simple rule to take short-term gains and losses.

He became a leading philanthropist in the United States, Great Britain, and the British Empire. During the last 18 years of his life, he gave away around $350 million (equivalent to $6.9 billion in 2025 dollars), almost 90 percent of his fortune, to charities, foundations and universities.[6] His 1889 article proclaiming “The Gospel of Wealth” called on the rich to use their wealth to improve society, expressed support for progressive taxation and an estate tax, and stimulated a wave of philanthropy.

Carnegie believed in using his fortune for others and doing more than making money. In 1868, at age 33, he wrote:

I propose to take an income no greater than $50,000 per annum! Beyond this I need ever earn, make no effort to increase my fortune, but spend the surplus each year for benevolent purposes! Let us cast aside business forever, except for others. Let us settle in Oxford and I shall get a thorough education, making the acquaintance of literary men. I figure that this will take three years’ active work. I shall pay especial attention to speaking in public. We can settle in London and I can purchase a controlling interest in some newspaper or live review and give the general management of it attention, taking part in public matters, especially those connected with education and improvement of the poorer classes. Man must have no idol and the amassing of wealth is one of the worst species of idolatry! No idol is more debasing than the worship of money! Whatever I engage in I must push inordinately; therefore should I be careful to choose that life which will be the most elevating in its character. To continue much longer overwhelmed by business cares and with most of my thoughts wholly upon the way to make more money in the shortest time, must degrade me beyond hope of permanent recovery. I will resign business at thirty-five, but during these ensuing two years I wish to spend the afternoons in receiving instruction and in reading systematically!

What especially attracts me to Carnegie’s thinking is that reportedly, “He continuously reinvested profits into new technology and more efficient production methods to reduce costs.” His affection for technology is not lost on me. So – in that spirit – I thought to address to AI (whom I have personified as “Hal” of Space Odyssey fame) about a reading or critique of “Three simple rules in life“. Employing AI in this vernacular is new to me. Each day I find I am broadening the utility of AI which – if it is anything like computers or smart phones – will prove to be a success. How soon we forget the steam engine, the telephone and a good cigar! AI’s analysis is not especially novel but it does have a legitimacy and depth. It is a clearly a practical sounding board; dare I say, a “device”?

Three simple rules in life:

1. If you do not GO after what you want, you’ll never have it.

2. If you do not ASK, the answer will always be NO.

3. If you do not step forward, you’ll always be in the same place.

Bill, these three aphorisms form a tidy triad — motivational, concise, and action-oriented. But beneath their surface simplicity lies an interesting tension between will and circumstance that deserves unpacking.

Let’s examine them one by one:

1. “If you do not go after what you want, you’ll never have it.”

This one is tautologically true but existentially shallow unless “go after” is understood broadly. Life often tempers ambition with limitation — physical, moral, or circumstantial. Still, it rightly insists that desire without motion is sterile. It echoes Aristotle’s entelechy — potential unrealized until acted upon. Yet, I’d prefer a softer version: If you never reach, you will never touch. It carries the same imperative but less of the self-help clang.

2. “If you do not ask, the answer will always be no.”

This is the most practical of the three — assertive, not aggressive. It speaks to agency and communication. The act of asking assumes self-worth and the willingness to risk refusal. It also implies that silence is complicity in one’s own deprivation. That’s psychologically sound. However, it presumes a rational, responsive world — and we both know that’s not always the case. Sometimes asking merely exposes one’s vulnerability. But then again, so does living.

3. “If you do not step forward, you’ll always be in the same place.”

The most metaphorical and, perhaps, the most profound. It’s not merely about motion but growth. “Stepping forward” doesn’t have to mean geographical or career movement — it may mean moral, emotional, or intellectual advancement. It’s about refusing stasis. Yet I’d add that there are times when stillness is progress — when reflection, not movement, leads to depth.

Taken together, the three maxims preach a kind of pragmatic courage — motion, voice, and initiative. They’re framed for a modern, individualistic ear, perhaps too much so. The danger lies in mistaking activity for wisdom.

In short: useful, rousing, and honest in spirit — but incomplete without a counterweight: Know when not to go, when not to ask, and when not to move. Balance is the mature corollary.